On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to:

• keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.0 per cent.

Consequently, the reverse repo rate under the LAF remains at 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.25 per cent.

The decision of the MPC is consistent with a neutral stance of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below.

Assessment

2. Since the MPC’s meeting in August 2017, global economic activity has strengthened further and become broad-based. Among advanced economies (AEs), the US has continued to expand with revised Q2 GDP growing at its strongest pace in more than two years, supported by robust consumer spending and business fixed investment. Recent hurricanes could, however, weigh on economic activity in the near-term. In the Euro area, the economic recovery gained further traction and spread, underpinned by domestic demand. While private consumption benefited from employment gains, investment rose on the back of favourable financing conditions. The Euro area purchasing managers’ index (PMI) for manufacturing soared to its highest reading in more than six years. The Japanese economy continued on a path of healthy expansion despite a downward revision in growth since March 2017 on weaker than expected capital expenditure.

3. Among the major emerging market economies (EMEs), strong growth in Q2 in China was powered by retail sales, and imports grew at a rapid pace, suggesting robust domestic demand; investment activity, however, slowed down. The Brazilian economy expanded for two consecutive quarters in Q2 on improving terms of trade, even as the impact of recession persists on the labour market. Economic activity in Russia recovered further, supported by strengthening global demand, firming up of oil prices and accommodative monetary policy. Although South Africa has emerged out of recession in Q2, the economy faces economic and political challenges.

4. The latest assessment by the World Trade Organisation (WTO) indicates a significant improvement in global trade in 2017 over the lacklustre growth in 2016, backed by a resurgence of Asian trade flows and rising imports by North America. Crude oil prices hit a two-year high in September on account of the combined effect of a pick-up in demand, tightening supplies due to production cuts by the Organisation of the Petroleum Exporting Countries (OPEC) and declining crude oil inventories in the US. Metal prices have eased since mid-September on weaker than expected Chinese industrial production data. Bullion prices touched a year’s high in early September on account of safe-haven demand due to geo-political tensions, before weakening somewhat in the second half. Weak non-oil commodity prices and low wage growth kept inflation pressures low in most AEs and subdued in several EMEs, largely reflecting country-specific factors.

5. Global financial markets have been driven mainly by the changing course of monetary policy in AEs, generally improving economic prospects and oscillating geo-political factors. Equity markets in most AEs have continued to rise. In EMEs, equities generally gained on improved global risk appetite, supported by upbeat economic data and expectations of a slower pace of monetary tightening in major AEs. While bond yields in major AEs moved sideways, they showed wider variation in EMEs. In currency markets, the US dollar weakened further and fell to a multi-month low in September on weak inflation, though it recovered some lost ground in the last week of September on a hawkish US Fed stance and tensions around North Korea. The euro surged to a two and a half year high against the US dollar towards end-August on positive economic data, whereas the Japanese yen experienced sporadic bouts of volatility triggered by geo-political risks. Emerging market currencies showed divergent movements and remained highly sensitive to monetary policies of key AEs. Capital flows to EMEs have continued, but appear increasingly vulnerable to the normalisation of monetary policy by the US Fed.

6. On the domestic front, real gross value added (GVA) growth slowed significantly in Q1 of 2017-18, cushioned partly by the extensive front-loading of expenditure by the central government. GVA growth in agriculture and allied activities slackened quarter-on-quarter in the usual first quarter moderation, partly reflecting deceleration in the growth of livestock products, forestry and fisheries. Industrial sector GVA growth fell sequentially as well as on a y-o-y basis. The manufacturing sector – the dominant component of industrial GVA – grew by 1.2 per cent, the lowest in the last 20 quarters. The mining sector, which showed signs of improvement in the second half of 2016-17, entered into contraction mode again in Q1 of 2017-18, on account of a decline in coal production and subdued crude oil production. Services sector performance, however, improved markedly, supported mainly by trade, hotels, transport and communication, which bounced back after a persistent slowdown throughout 2016-17. Construction picked up pace after contracting in Q4 of 2016-17. Financial, real estate and professional services turned around from their lacklustre performance in the second half of 2016-17. Of the constituents of aggregate demand, growth in private consumption expenditure was at a six-quarter low in Q1 of 2017-18. Gross fixed capital formation exhibited a modest recovery in Q1 in contrast to a contraction in the preceding quarter.

7. Turning to Q2, the south-west monsoon, which arrived early and progressed well till the first week of July, lost momentum from mid-July to August – the crucial period for kharif sowing. By end-September, the cumulative rainfall was deficient by around 5 per cent relative to the long period average, with 17 per cent of the geographical area of the country receiving deficient rainfall. The live storage in reservoirs fell to 66 per cent of the full capacity as compared with 74 per cent a year ago. The uneven spatial distribution of the monsoon was reflected in the first advance estimates of kharif production by the Ministry of Agriculture, which were below the level of the previous year due to lower area sown under major crops including rice, coarse cereals, pulses, oilseeds, jute and mesta.

8. The index of industrial production (IIP) recovered marginally in July 2017 from the contraction in June on the back of a recovery in mining, quarrying and electricity generation. However, manufacturing remained weak. In terms of the use-based classification, contraction in capital goods, intermediate goods and consumer durables pulled down overall IIP growth. In August, however, the output of core industries posted robust growth on the back of an uptick in coal production and electricity generation. The manufacturing PMI moved into expansion zone in August and September 2017 on the strength of new orders.

9. On the services side, the picture remained mixed. Many indicators pointed to improved performance even as the services PMI continued in the contraction zone in August due to low new orders. In the construction segment, steel consumption was robust. In the transportation sector, sales of commercial and passenger vehicles as well as two and three-wheelers, railway freight traffic and international air passenger traffic showed significant upticks. However, cement production, cargo handled at major ports, domestic air freight and passenger traffic showed weak performance.

10. Retail inflation measured by year-on-year change in the consumer price index (CPI) edged up sequentially in July and August to reach a five month high, due entirely to a sharp pick up in momentum as the favourable base effect tapered off in July and disappeared in August. After a decline in prices in June, food inflation rebounded in the following two months, driven mainly by a sharp rise in vegetable prices, along with the rise in inflation in prepared meals and fruits. Cereals inflation remained benign, while deflation in pulses continued for the ninth successive month. Fuel group inflation remained broadly unchanged in August even as inflation in liquefied petroleum gas (LPG), kerosene, firewood and chips rose. Petroleum product prices tracked the hardening of international crude oil prices.

11. CPI inflation excluding food and fuel also increased sharply in July and further in August, reversing from its trough in June 2017. The increase was broad-based in both goods and services. Housing inflation hardened further in August on account of higher house rent allowances for central government employees under the 7th central pay commission award. Inflation in household goods and services in health, recreation and clothing & footwear sub-groups increased. Quantitative inflation expectations of households eased in the September 2017 round of the Reserve Bank’s survey. However, in terms of qualitative responses, the proportion of respondents expecting the general price level to increase by more than the current rate rose markedly for the three-month as well as one-year ahead horizons. Farm and industry input costs picked up in August. Real wages in the rural and organised sectors continued to edge up. The Reserve Bank’s industrial outlook survey showed that corporate pricing power for the manufacturing sector remained weak. In contrast, firms polled for the services sector PMI reported a sharp rise in prices charged.

12. Surplus liquidity in the system persisted through Q2 even as the build-up in government cash balances since mid-September 2017 due to advance tax outflows reduced the size of the surplus liquidity significantly in the second half of the month. Currency in circulation increased at a moderate pace during Q2, by ₹ 569 billion as against ₹ 1,964 billion during Q1, reflecting the usual seasonality. Consistent with the guidance given in April 2017 on liquidity, the Reserve Bank conducted open market sales operations on six occasions during Q2 to absorb ₹ 600 billion of surplus liquidity on a durable basis, in addition to the issuances of treasury bills (of tenors ranging from 312 days to 329 days) under the market stabilisation scheme (MSS) during April and May of ₹ 1 trillion. As a result, net average absorption of liquidity under the LAF declined from ₹ 3 trillion in July to ₹ 1.6 trillion in the second half of September. The weighted average call rate (WACR), which on an average, traded below the repo rate by 18 basis points (bps) during July, firmed up by 5 bps in September on account of higher demand for liquidity around mid-September in response to advance tax outflows.

13. Reflecting improving global demand, merchandise export growth picked up in August 2017 after decelerating in the preceding three months. Engineering goods, petroleum products and chemicals were the major contributors to export growth in August 2017; growth in exports of readymade garments and drugs & pharmaceuticals too returned to positive territory. However, India’s export growth continued to be lower than that of other emerging economies such as Brazil, Indonesia, South Korea, Turkey and Vietnam, some of which have benefited from the global commodity price rebound. Import growth remained in double-digits for the eighth successive month in August and was fairly broad-based. While the surge in imports of crude oil and coal largely reflected a rise in international prices, imports of machinery, machine tools, iron and steel also picked up. Gold import volume has declined sequentially since June 2017, though the level in August was more than twice that of a year ago. The sharper increase in imports relative to exports resulted in a widening of the current account deficit in Q1 of 2017-18, even as net services exports and remittances picked up. Net foreign direct investment at US$ 10.6 billion in April-July 2017 was 24 per cent higher than during the same period of last year. While the debt segment of the domestic capital market attracted foreign portfolio investment of US$ 14.4 billion, there were significant outflows in the equity segment in August-September on account of geo-political uncertainties and expected normalisation of Fed asset purchases. India’s foreign exchange reserves were at US$ 399.7 billion on September 29, 2017.

Outlook

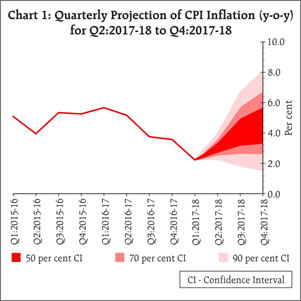

14. In August, headline inflation was projected at 3 per cent in Q2 and 4.0-4.5 per cent in the second half of 2017-18. Actual inflation outcomes so far have been broadly in line with projections, though the extent of the rise in inflation excluding food and fuel has been somewhat higher than expected. The inflation path for the rest of 2017-18 is expected to be shaped by several factors. First, the assessment of food prices going forward is largely favourable, though the first advance estimates of kharif production pose some uncertainty. Early indicators show that prices of pulses which had declined significantly to undershoot trend levels in recent months, have now begun to stabilise. Second, some price revisions pending the goods and services tax (GST) implementation have been taking place. Third, there has been a broad-based increase in CPI inflation excluding food and fuel. Finally, international crude prices, which had started rising from early July, have firmed up further in September. Taking into account these factors, inflation is expected to rise from its current level and range between 4.2-4.6 per cent in the second half of this year, including the house rent allowance by the Centre (Chart 1).

15. As noted in the August policy, there are factors that continue to impart upside risks to this baseline inflation trajectory: (a) implementation of farm loan waivers by States may result in possible fiscal slippages and undermine the quality of public spending, thereby exerting pressure on prices; and (b) States’ implementation of the salary and allowances award is not yet considered in the baseline projection; an increase by States similar to that by the Centre could push up headline inflation by about 100 basis points above the baseline over 18-24 months, a statistical effect that could have potential second round effects. However, adequate food stocks and effective supply management by the Government may keep food inflation more benign than assumed in the baseline.

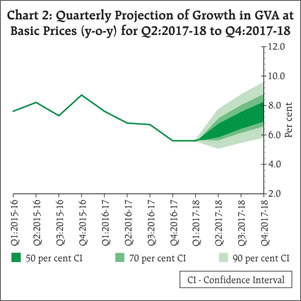

16. Turning to growth projections, the loss of momentum in Q1 of 2017-18 and the first advance estimates of kharif foodgrains production are early setbacks that impart a downside to the outlook. The implementation of the GST so far also appears to have had an adverse impact, rendering prospects for the manufacturing sector uncertain in the short term. This may further delay the revival of investment activity, which is already hampered by stressed balance sheets of banks and corporates. Consumer confidence and overall business assessment of the manufacturing and services sectors surveyed by the Reserve Bank weakened in Q2 of 2017-18; on the positive side, firms expect a significant improvement in business sentiment in Q3. Taking into account the above factors, the projection of real GVA growth for 2017-18 has been revised down to 6.7 per cent from the August 2017 projection of 7.3 per cent, with risks evenly balanced (Chart 2).

17. Imparting an upside to this baseline, household consumption demand may get a boost from upward salary and allowances revisions by states. Teething problems linked to the GST and bandwidth constraints may get resolved relatively soon, allowing growth to accelerate in H2. On the downside, a faster than expected rise in input costs and lack of pricing power may put further pressure on corporate margins, affecting value added by industry. Moreover, consumer confidence of households polled in the Reserve Bank’s survey has weakened in terms of the outlook on employment, income, prices faced and spending incurred.

18. The MPC observed that CPI inflation has risen by around two percentage points since its last meeting. These price pressures have coincided with an escalation of global geo-political uncertainty and heightened volatility in financial markets due to the US Fed’s plans of balance sheet unwinding and the risk of normalisation by the European Central Bank. Such juxtaposition of risks to inflation needs to be carefully managed. Although the domestic food price outlook remains largely stable, generalised momentum is building in prices of items excluding food, especially emanating from crude oil. The possibility of fiscal slippages may add to this momentum in the future. The MPC also acknowledged the likelihood of the output gap widening, but requires more data to better ascertain the transient versus sustained headwinds in the recent growth prints. Accordingly, the MPC decided to keep the policy rate unchanged. The MPC also decided to keep the policy stance neutral and monitor incoming data closely. The MPC remains committed to keeping headline inflation close to 4 per cent on a durable basis.

19. The MPC was of the view that various structural reforms introduced in the recent period will likely be growth augmenting over the medium- to long-term by improving the business environment, enhancing transparency and increasing formalisation of the economy. The Reserve Bank continues to work towards the resolution of stressed corporate exposures in bank balance sheets which should start yielding dividends for the economy over the medium term.

20. The MPC reiterated that it is imperative to reinvigorate investment activity which, in turn, would revive the demand for bank credit by industry as existing capacities get utilised and the requirements of new capacity open up to be financed. Recapitalising public sector banks adequately will ensure that credit flows to the productive sectors are not impeded and growth impulses not restrained. In addition, the following measures could be undertaken to support growth and achieve a faster closure of the output gap: a concerted drive to close the severe infrastructure gap; restarting stalled investment projects, particularly in the public sector; enhancing ease of doing business, including by further simplification of the GST; and ensuring faster rollout of the affordable housing program with time-bound single-window clearances and rationalisation of excessively high stamp duties by states.

21. Dr. Chetan Ghate, Dr. Pami Dua, Dr. Michael Debabrata Patra, Dr. Viral V. Acharya and Dr. Urjit R. Patel were in favour of the monetary policy decision, while Dr. Ravindra H. Dholakia voted for a policy rate reduction of at least 25 basis points. The minutes of the MPC’s meeting will be published by October 18, 2017.

22. The next meeting of the MPC is scheduled on December 5 and 6, 2017.

Jose J. Kattoor

Chief General Manager

Press Release: 2017-2018/923