The Income Tax department of India offers tax deductions which help everyone to save tax legally by appropriately making use of the service. It is pretty essential that you invest in more than one avenue as you want to avail better returns with less tax burden. There are various ways in which tax deductions can be claimed for, one of them is medical expenditure, wherein you can claim for it. However, there is more than one IT section available, when it comes to availing tax deduction.

Here are Few of the Most Popular Sections through which you can Avail Tax Deductions:

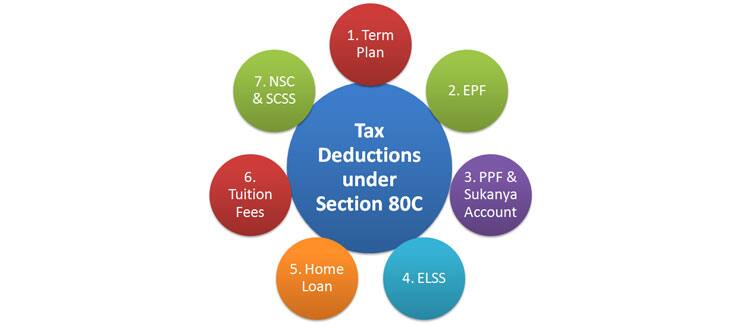

Income Tax Deduction offered under Section 80C: As for Section 80C, you are entitled to receive a tax deduction. Under this section, you can invest of up to INR 1, 50,000/- from your annual income and can claim a tax deduction on the same. The Income Tax Department has specified various instruments under which an investor can claim a tax deduction. These are as follows:

- FD Investment Plans,

- Public Provident Fund (PPF)

- Contribution to Employee Provident Fund (EPF)

- Mutual Funds

- Equity Oriented Mutual Funds

- National Savings Certificate (NSC)

- Repayment of Principal Amount on Home Loan, Life Insurance Policy

Income Tax Deduction offered under Section 80CCC and 80CCD: This section caters to the investment made in pension plans. These pension plans are offered by the insurance companies have a limit of INR 1, 50,000/- till which tax deduction can be claimed. Apart from this contribution made to the Governments’ National Pension Scheme (NPS) is entitled to tax deduction as well.

Income Tax Deduction offered under Section 80TTA: This section allows tax deduction up to the amount of INR 10,000 for interest that is earned on a savings account. For this, the interest earned has to be specified under income from other sources.

Income Tax Deduction under 80DD, 80U, 80DDB: These sections cater to a tax deduction on medical expenses of an individual and his family including the medical insurance. Apart from that special provision has been made for the people who are certified with 40% or 80% disability. The medical expenditure incurred on self, in their case can be claimed for a tax deduction of up to INR 1, 25,000/-. Section 80DDB helps in a tax deduction of up to INR 80,000 for the people above the age of 80 years. Under the same section, senior citizens can avail benefits of up to INR 60,000 and others can avail tax benefits of up to INR 40,000 for medical purposes. These tax deductions are available if medical expenses are incurred in treating certain medical conditions such as:

- Hematological Disorders

- Neurological Diseases

- AIDS

- Chronic Renal Failure

- Malignant Cancers

Income Tax Deduction offered under Section 80E: This section deals with tax exemption interest earned through education. However, there is no particular amount mentioned that can be claimed for tax deduction under Section 80E.

Income Tax Deduction offered under Section 80G: This section focuses on the donations made in the specified government organisations. However, there is no limit as to how much you can donate and claim a tax deduction.

These are few of the sections which can help you avail tax deduction on fixed deposits and other investments. Thus, if you have invested in any of these avenues, you must apply for tax deductions.

Hello corporatelawreporter.com admin, Your posts are always well-cited and reliable.