(Speech delivered by Dr Deepali Pant Joshi, Executive Director, Reserve Bank of India at MITE Mangalore on May 04, 2013)

Respected Dr. Thingalaya, Former CMD Syndicate Bank, Dr. G. L. Easwara Prasad, Principal, Mangalore Institute of Technology and Engineering, senior bankers and dear students. I am extremely delighted to be amongst you in this prestigious institute which has several achievements in engineering studies to its credit in a very short span of time. I am honoured, privileged and happy to inaugurate this topical seminar aptly titled Indian Banking Sector Big Challenges and the Road Ahead and speak in a hallowed place which is considered the cradle of Indian Banking. I felicitate the organizers and especially respected Dr Thingalaya and thank you for having me here.

The global financial crisis and the current Euro zone crisis have affected the banks in the advanced economies; the spillover is ricocheting on banks in emerging economies including India. Issues of financial stability, economic growth and managing inflation are the major challenges confronting regulators in advanced economies and are equally important for emerging economies like ours. Global economic growth has slowed from 3.9% in 2011 to 3.2% in 2012 we are not unaffected by what happens in the rest of the world our economy too has slowed after 2010-11. In the current year CSO has projected a growth estimation of 5% while the RBI has put it at 5.5%. As Shri Chidambaram our Finance Minister has rightly put it Whatever be the final estimate it will be below India™s potential growth rate of 8%, getting back to that growth rate will be the challenge that faces the country. This is clearly not feasible if large sections of society remain marginalized and people who lack access to financial services from Institutional service providers are not mainstreamed .The challenge of financial inclusion presents an inflexion point for Indian banking

The biggest challenge for next decade or more to banks in the country is to capture the banking business of over 50% population of this country of over 120 billion people. Today, I will use the opportunity to discuss contemporary challenges facing Indian Rural Banking, i.e, Priority Sector Lending, Regional Rural Banks, Financial Inclusion, Financial Literacy and Education. Aptly Dr. Subbarao, RBI Governor terms Financial Inclusion as the supply side of the equation and Financial Literacy the demand side.

The definition of priority sectors has evolved over a period of time and at present, priority sectors are broadly taken as those sectors of the economy which in the absence of inclusion in the priority sector categories would not get timely and adequate finance. Typically, these are small loans to small and marginal farmers for agriculture and allied activities, loans to Micro and Small Enterprises, loans for small housing projects, education loans and other small loans to people with low income levels. Presently, the target for aggregate advances to the priority sector is 40 per cent of the Adjusted Net Bank Credit ANBC or the credit equivalent of Off Balance sheet Exposure (OBE), whichever is higher for domestic banks. Foreign banks with 20 or more branches in the country are being brought on par with domestic banks for priority sector targets in a phased manner over a five year period starting from April 1, 2013. For foreign banks with less than 20 branches the overall target is fixed at 32 per cent.

The domestic banks, i.e, public and private sector, could not achieve the target of 40 percent for the year 2012 as can be evidenced from the table below.

|

Priority Sector Lending by banks |

|||

|

(Amount in Rs. billion) |

|||

|

As on the Last Reporting Friday of March |

Public Sector Banks |

Private Sector Banks |

Foreign Banks |

|

2011 |

10,215 |

2,491 |

667 |

|

|

(41.0) |

(46.7) |

(39.7) |

|

2012 |

11,299 |

2,864 |

805 |

|

|

(37.4) |

(39.4) |

(40.8) |

| Notes: 1. Figures in parentheses are percentages to ANBC or credit equivalent of off balance sheet exposure (OBE), whichever is higher, in the respective groups. Source: RBI Annual Report 2012 |

|||

As per 59th NSS Survey, households with 2 hectare or less land accounted for 84% of all farmer households. The percentages of such small and marginal famers who have access to credit is only 46.3%. A large section of farmers is still dependent on moneylenders for their financial needs.

|

Shares in Total debt of Cultivator Households |

||||||

|

(Per cent) |

||||||

| Source of debt |

1951 |

1961 |

1971 |

1981 |

1991 |

2002 |

| Institutional |

7.3 |

18.7 |

31.7 |

63.2 |

66.3 |

61.1 |

| Non-Institutional |

92.7 |

81.3 |

68.3 |

36.8 |

30.6 |

38.9 |

| Money Lenders |

69.7 |

49.2 |

36.1 |

16.1 |

17.5 |

26.8 |

| Total |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

| Source: All India Debt and Investment Survey, NSSO, GoI, various rounds. | ||||||

The major challenge is to bring all farmers into the institutionalcredit framework. To boost the credit to agriculture sector, apart from a host of initiatives, the Kisan Credit Card (KCC) Scheme was introduced in the year 1998-99 to enable farmers to purchase agricultural inputs and draw cash for their production needs. In 2004, NABARD revised the Model KCC Scheme to provide adequate and timely finance for meeting the comprehensive credit requirements of farmers under single window, with flexible and simplified procedure, adopting whole farm approach. The scheme now covers term credit as also working capital for agriculture and allied activities and a reasonable component for consumption needs. During 2011-12, public sector banks have issued 68,03,051 KCCs with sanctioned limits aggregating to Rs. 69,51,768.45 lakh. Since inception of the scheme, the number of KCCs issued by public sector banks stood at 5,47,49,373.00 till March 2012 with sanctioned limits aggregating to Rs. 3,53,14,527.11 lakh. We have recently revised the guidelines on Kisan Credit Card scheme. Margin /security norms are waived for loans up to Rs.1 lakh to enhance the flow and easy delivery of bank loans to small agricultural borrowers.

The revised priority sector guidelines lay emphasis on direct delivery of credit to the poor beneficiaries i.e. without the involvement of intermediaries, which will ensure better management of risks and also reduction in transaction, delivery and administrative costs for these loans, which being essentially small ticket, low value high volume loans, do generate profits translating to a stable low cost deposit stream for banks and to the fortune at the bottom of the pyramid.

To make priority sector lending viable for the banks, RBI has removed the interest rate ceiling on all types of loans including small loans by linking it to Base Rate of the banks with effect from April 1, 2010. Thus, there is no preferential rate of interest for priority sector loans. Thus priority sector lending is competitive and commercially viable.

Why have we removed caps on pricing? The cost of absence of bank lending to poor and vulnerable sections of the society is heavy, as the poor have no option but to borrow from the unorganized sector, the informal or alternative channels at usurious price. There is a need for reorienting the approach of banks to look at priority sector areas. The challenges in priority sector can be overcome only if banks consider priority sector lending as part of normal business operations of the banks and not as an obligation. Rural untapped market offers a big business opportunity to the banks. Banks need to innovate new products which cater to the needs of farmers, weaker sections and other vulnerable sections of the society, develop new delivery channels and embrace technological developments which will reduce the delivery costs. Priority sector must be treated as a viable business proposition.

(ii) Regional Rural Banks

Regional Rural Banks (RRBs) were established in the year 1976 as a low cost financial intermediation structure in the rural areas to ensure sufficient flow of institutional credit for agriculture and other rural sectors. RRBs were expected to have the local feel and familiarity of the cooperative banks with the managerial expertise of the commercial banks. RRBs are jointly owned by GoI, the concerned State Government and Sponsor Banks, the issued capital of a RRB is shared by the owners in the proportion of 50 percent, 15 percent and 35 percent respectively. In practice they borrowed the politicization in lending, rampant in cooperative Banks, with the worst form of unionism replicated from the commercial banks. The low cost structure was also washed away after the Obul Reddy report which brought parity of pay scales with Commercial Banks.

Several RRBs suffered humongous losses. Government of India and RBI initiated several measures to improve the financial health of RRBs. During a review carried out by GOI in the year 2009 it was found that the Capital Risk Weighted Assets Ratio (CRAR) of the RRBs were too low. Dr. K.C Chakrabarty committee suggested bringing the CRAR of RRBs to at least 9 percent in a sustainable manner. The Committee inter-alia recommended recapitalization support to the extent of Rs. 2,200 crore, to 40 RRBs in 21 States, out of which Rs.1,100 crore was to be contributed by Central Government. The recapitalization process which started in 2010-11 has been extended till 2013-14. Several Committees looked into issues of viability finally amalgamation of RRBS on grounds of contiguity in a particular region was adopted. Initially, there were 196 RRBs working in the country. After the second phase of amalgamation, which started w.e.f. October 1, 2012, 34 RRBs have been amalgamated to form 14 new RRBs. After a massive consolidation and merger exercise to strengthen the RRBs, the number of RRBs operating in the country today has come down to 62.

The number of sustainably viable RRBs (i.e. RRBs making net current profit and having no accumulated losses) has increased to 60 as on March 31, 2012 as compared to 58 as on March 31, 2011.

(iii) Financial Inclusion

Now let me turn to extension of banking penetration and branch building. A massive exercise in this regard has been taken up by us and this is being done through the lead bank scheme channel. We advised banks in November 2009 to draw up a roadmap to provide banking services through a banking outlet in every village with a population of more than 2000 and the target date was March 2012. Banks were advised that such banking services need not necessarily be extended through a brick and mortar branch but could be provided through any of the various forms of ICT-based models including through BCs. Under the roadmap for providing banking outlets in villages with population above 2000, banking outlets have been opened in hitherto 74199 unbanked villages comprising 2493 branches, 69374 Business Correspondents (BCs) and 2332 through other modes like ATMs, mobile van, etc.

Now, you may well ask me; How do we plan to provide banking services to villages having population less than 2000? As per the announcement in the Annual policy Statement 2012-13, State Level Bankers’ Committees (SLBCs) were advised by RBI to prepare a roadmap covering all unbanked villages of population less than 2000 and notionally allot these villages to banks for providing banking services in a time bound manner, especially, to start with, EBT services. The objective is to provide a bank account to every household/person throughout the country. To start with, banks have been advised to provide door step services to EBT beneficiaries to facilitate transfer of all State benefits including MGNREGA wages and various cash subsidies to beneficiaries by direct credit to the bank accounts, through regular visits of BCs to the allocated villages and over a period of time, provide all kinds of banking services viz. remittances, recurring deposit, entrepreneurial credit in the form of KCC and GCC, insurance (life and non-life) and other banking services to all the residents of the village through a mix of brick and mortar branch and BC network. We have also emphasized planning of sufficient number of brick and mortar branches so that there is a brick and mortar branch to provide support to a cluster of BC units, i.e., about 8-10 BC units at a reasonable distance of 3-4 kilometers. As per the Roadmap drawn about 484000 villages with population less than 2000 have been allotted to various banks for provision of banking services in next 3 years.

Financial Inclusion Plan

Financial Inclusion (FI) is the process of ensuring access to appropriate financial products and services needed by all sections of the society in general and vulnerable groups such as weaker sections and low income groups in particular at an affordable cost in a fair and transparent manner by mainstream institutional players. Reserve Bank has adopted a bank- led model for financial inclusion which seeks to leverage on technology. In January 2006, the Reserve Bank permitted banks to utilise the services of non-governmental organizations (NGOs), micro-finance institutions (other than Non-Banking Financial Companies) and other civil society organisations as intermediaries in providing financial and banking services through the use of business facilitator and business correspondent (BC) models. The BC model allows banks to do ˜cash in – cash out™ transactions at a location much closer to the rural population, thus addressing the last mile problem.

Reserve Bank has been furthering financial inclusion in a mission mode through a combination of strategies ranging from relaxation of regulatory guidelines, provision of new products and other supportive measures to achieve sustainable and scalable Financial Inclusion. A structured and planned approach was followed under financial inclusion wherein all banks were advised in January 2010 to prepare Board approved Financial Inclusion Plans (FIPs) congruent with their business strategies and comparative advantage for three year period extending up to 2013. The implementation of these plans was closely monitored by the Reserve Bank through quantitative & qualitative reporting formats and through review meetings held with CMDs/CEOs and other senior officials of banks.

I am sure you would like to know what was the performance of banks under the first three year Financial Inclusion Plan period (2010-13)?

The Financial Inclusion Plan (2010-13), introduced in April 2010 has concluded in March 2013. The penetration of baking services in the rural areas has increased to a great extent.

A snapshot of the progress made by banks, upto December 31 2012, under FIP for certain key parameters is given below:-

i. Banking connectivity has been extended to 2,11,234/- villages from 67,694 at the beginning of the plan period. 5694 rural branches have been opened during the period.

ii. Numbers of Business Correspondents have increased from 34,532 to 1,52,328.

iii. Total number of Basic Savings Bank Deposit Accounts (BSBDAs) have gone up from 73.45 million in 2010 to 171.43 million upto December 31 2012, Number of Kissan Credit Cards outstanding have gone up from 24.31 million in 2010 to 31.73 million upto December 31 2012 and Number of General Credit Cards outstanding have gone up from 1.39 million in 2010 to 3.11 million upto December 31 2012.

iv.

v. The number of ICT based BC transactions though encouraging is still very low as compared to the increase in the number of banking outlets. The focus on monitoring has, therefore, now shifted more towards the number and value of transactions in no-frills, credit and remittance accounts opened through BCs. In this direction, we have now advised banks to disaggregate the FIP upto the branch level and we have involved the controlling offices of respective banks as also the Regional Offices of RBI in all the States in the monitoring process.

Naturally you will want to know what are some of the major issues being faced by banks in pursuing and achieving the Financial Inclusion Plan targets?

Efficient Business Model

Banks are yet to perceive FI as a profitable business model. Feedback received suggests that many banks are still pursuing FI as a regulatory requirement rather than treating it as a business model. Banks have to realize that the bankability of the poor holds a major opportunity for the banking sector in developing a stable retail deposit base and in curbing volatility in earnings with the help of a diversified asset portfolio. The recent crisis has underscored the need for reducing banks™ reliance on wholesale deposits and borrowed funds and cultivating a retail portfolio of assets and liabilities for financial stability. Two basic issues that need to be understood by banks while implementing financial inclusion is that:-

- Financial Inclusion programmes should be implemented on commercial lines and not on a charity basis. It is important that banking with the poor is perceived and pursued as a sustainable and viable business model.

- While poor need not be subsidized, it is important to ensure that they are not exploited. The need is to ensure that poor people who deserve credit are provided access to timely and adequate credit in a non-exploitative manner.

BC Model – Viability Issues:

Business Correspondent model is still in the experimental stages and there are various challenges associated with the model. The viability of BC model has remained a critical issue. Surveys have revealed that branch officials do not visit BCs or customers and do not take any effort in introducing BCs to villagers. One primary reason cited by branch officials are the scarcity of staff provided to them for carrying out such visits to villages. Further, most of the accounts opened by BCs have remained non-operational. In order to ensure participation of all stake holders in the financial inclusion process, we have advised banks to disaggregate the FIPs upto the Controlling Office and branch level. This would ensure that bank officials at the ground level are aware of the banks objective under FI and of the specific targets given to each Zone/branch for achieving the objectives.

Technology Issues

Another bottleneck in achieving financial inclusion is the non-availability of physical and digital connectivity. For the success of the ICT based model, resolving technology related issues is the key.

iv) Financial Literacy

Financial Inclusion and Financial Literacy are two sides of the equation. Financial Inclusion acts from supply side by providing financial market/services that people demand whereas Financial Literacy stimulates the demand side by making people aware of what they can demand. Therefore, access to financial services and Financial Education must happen simultaneously. It must be continuous, an ongoing process and must target all sections of the population.

Financial awareness has to be spread amongst the excluded masses that are illiterate and poor. For this, evolving an appropriate Business Model & an Efficient Delivery Mechanism is the major challenge for banks. For disseminating financial literacy and awareness, a National Level Coordination of all stakeholders like Banks, Governments, Civil Societies, NGOs, etc. is required. In India, the need for financial literacy is even greater considering the low levels of literacy and the large section of the population still out of the formal financial system. To ensure effective coordination of the efforts made by all the financial regulators and other stakeholders, a Technical Group on Financial Inclusion and Financial Literacy has been constituted under the aegis of Financial Stability and Development Council.The technical group is headed by the Deputy Governor, RBI, Dr Chakrabarty with members drawn from SEBI, PFRDA, IRDA, Government of India, State Governments, Central Education Board etc. The Group is in dialogue with NCERT/State Education Boards for inclusion of financial literacy in CBSE/State curriculum.

A national strategy on financial education has been prepared which would cater to all sections of the population in the country. Since the challenge is to link large number of financially excluded people to the formal financial system, the focus of the strategy at the base level will be to create awareness of basic financial products through dissemination of simple messages of financial prudence in vernacular language through large campaigns across the country.

The Reserve Bank of India had launched Project Financial Literacy in March 2007 with a view to create awareness, especially among the common persons, on matters relating to banking, finance and central banking. Under Project Financial Literacy, several initiatives have been taken to achieve financial awareness and literacy among various target groups, which included publication of comic books on banking and RBI; games on Financial Education; arranging school/college visits for creating financial awareness; participation in exhibitions/fairs/melas at the State & District levels; conducting essay competitions and quizzes in schools to create awareness about banking and RBI; outreach programmes undertaken by theTop Management and Regional Offices; RBI™s Young Scholars Scheme, etc.

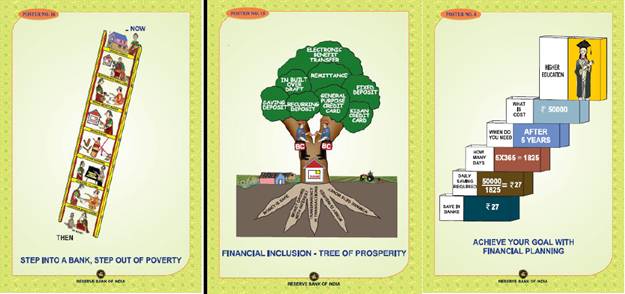

Banks have been advised to setup Financial Literacy Centres (FLCs) in the 630 plus offices of the Lead District Managers (LDMs). As at the end of December 2012, 658 FLCs were functioning and 1.5 million people were educated during the period April to December 2012. Further, 35,000 rural branches of SCBs including RRBs have been mandated to undertake outdoor financial literacy activities, at least once a month, with focus on financially excluded population. In order to link the financially excluded segment with the banking system, a ˜Model™ for conduct of Literacy Camps to be held by banks has been designed, detailing the operational modalities to culminate in effective financial access to the excluded people. Further, to ensure consistency in the financial literacy material reaching the target audience in a simple and lucid manner, RBI has prepared a comprehensive Financial Literacy Material consisting of a Financial Literacy Guide, Financial Diary and a set of 16 Financial Literacy Posters (few posters have been displayed below).

v) Education

One of the most important things, which I want to touch upon before concluding is education, as I see there are a large number of youngsters assembled here. The efforts and outlay made by Government alone will not meet the requirements of outlay on education. The scope of education has widened both in India and abroad covering new courses in diversified areas. Realizing the importance of education for economic development and raising overall living standards, RBI, has classified loans and advances granted to individuals for educational purposes, including vocational courses up to Rs. 10 lakh for studies in India and Rs.20 lakh for studies abroad, under ‘priority sector’. With a view to enable banks, the Indian Banks’ Association has brought out a model scheme for educational loan in the year 2001, which facilitated economically weaker sections of the society to avail educational loans from scheduled banks with modified easier norms. The Scheme was revised by IBA subsequently, the latest being in September 2012.

Loans for education should be seen as an investment for economic development and prosperity, since knowledge and information would be the principal driving force for economic growth in the coming years

In the end, I would sum up by saying that I am hopeful that with our recently revised priority sector norms, focusing on small loans directly to small and marginal farmers, micro and small enterprises low cost housing projects, student and people with low income the banks will see priority sectors as viable business opportunity to reach financial excluded sections of the population. In the coming 10-15 years banks in India in particular would realign their position in the pecking order based on their ability to convert financial inclusion into a viable business opportunity. Banks which are able to craft appropriate business and delivery models to tap the large excluded sections of society would come on top. The triad of financial inclusion, financial literacy and financial stability would be extremely relevant in the foreseeable future. The depth and breadth of banking in the country would determine financial stability.

The Banking sector has played a crucial role in developing the rural economy by providing credit and creating financial awareness. But as we are aware, despite all the efforts that we have made, a huge section of the rural population is still out of the banking net. Rural India has huge potential for development and as I said earlier it provides tremendous business opportunity for the banks, I urge the bankers through this platform to put their heart and soul in making a rural India where each and every household has a bank account and is imbued with financial awareness. Where Bharat and India morph to one entity and growth with equity becomes a reality.

Let me again close echoing our Finance Ministers words Any economist will tell us what India can become as we are the tenth largest economy in the world. We can become the eighth or perhaps the seventh largest by 2017. By 2025 we could become a $5 trillion economy and among the top five in the world. What we will become depends on us and the choices that we make. As Swami Vivekananda, whose 150th birth anniversary we celebrated recently, said “Äll the strength and succor you want is within yourself, therefore make your own future and this young friends is quite the best advice I can give to you along with my best wishes for a bright future.

Heights by great men

Reached and kept

We’re not attained by sudden flight

They while their companions slept

We’re struggling upward in the night

I wish the seminar and your deliberations grand success. Thank you

*****